What Are Chart of Accounts? How It Works, Setting up & Pros

This capability is crucial for maintaining the accuracy of the COA, as it ensures that all entries are correct and accounted for, minimizing discrepancies and errors that can arise from manual entry. The Reconciliation Control Tower provides a comprehensive overview of the reconciliation status of all accounts within the COA. By offering real-time visibility into variances and discrepancies, this tool helps finance teams quickly identify and address issues, ensuring that the COA reflects accurate and current financial data. Chart of accounts (COA) is a financial tool that acts like an index for a business’s financial transactions.

Would you prefer to work with a financial professional remotely or in-person?

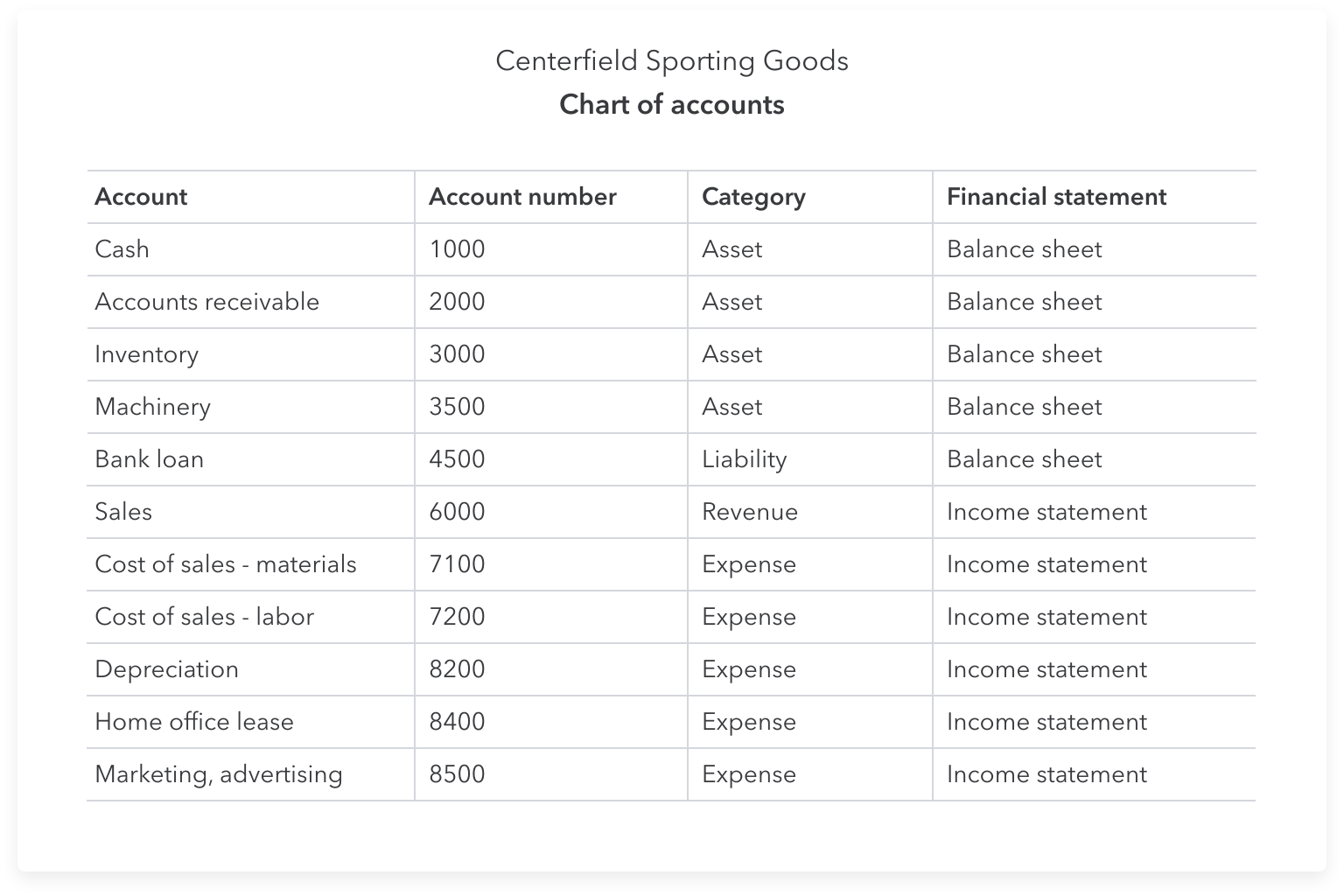

Similarly, if you use an online program that helps you manage all your accounts in one place, like Mint or Personal Capital, you’re looking at basically the same thing as a company’s COA. A chart of accounts (COA) is an index of all of the financial accounts in a company’s general ledger. In short, it is an organizational tool that lists by category and line item all of the financial transactions that a company conducted during a specific accounting period. You can think of this like a rolodex of accounts that the bookkeeper and the accounting software can use to record transactions, make reports, and prepare financial statements throughout the year.

All Categories

A chart of accounts records and categorizes all transactions, making sure that every dollar spent or earned is tracked accurately. Studies show that businesses that maintain a well-organized COA are better equipped to analyze their financial health and are more likely to make profitable decisions. Understanding the chart of accounts (COA) is important for anyone involved seek bromance in business finances. It’s the backbone of a company’s financial record-keeping system that must be observed and maintained with the utmost care. COA empowers you to make smart financial decisions based on clear, organized information. In 1494, an Italian mathematician, Luca Pacioli, wrote a book providing suggestions of how merchants could keep their records.

Our Services

- Accounts are classified into assets, liabilities, capital, income, and expenses; and each is given a unique account number.

- Instead of lumping all your income into one account, assess your various profitable activities and sort them by income type.

- It helps everyone in the company know exactly where the money is coming from and where it’s going.

- Provide each account with a clear title and a brief description that outlines the types of transactions it should capture.

Here’s a step-by-step guide to help you establish a COA that suits your business needs and enhances your financial reporting capabilities. The chart of accounts is useful in maintaining consistency and data integrity in recording transactions. Take note that the chart of accounts of one company may not be suitable for another company.

Liabilities

To better understand the balance sheet and income statement, you need to first understand the components that make up a chart of accounts. Knowing how to keep your company’s chart organized can make it easier for you to access financial information. Before you start, it’s important to keep in mind that your chart of accounts should reflect the unique financial needs and structure of your business.

To Ensure One Vote Per Person, Please Include the Following Info

Separating gains and losses allows businesses to analyze the impact of these non-operating activities separately from core business operations. As mentioned, besides the standard five accounts, the chart of accounts may contain additional accounts, created for the sake of more granularity or to cater to a business’s particular needs. They can vary, but the most typical here are the COGS, gains and losses, and other comprehensive income accounts.

If you’re using accounting software and want to set up a customized chart of accounts, you can add or edit parent and sub-accounts to the existing default chart of accounts. Doing this will help you stay organized and better understand how your business is doing financially. An added bonus of having a properly organized chart of accounts is that it simplifies tax season. The COA tracks your business income and expenses, which you’ll need to report on your income tax return every year. The chart of accounts allows you to organize your business’s complex financial data and distill it into clear, logical account types.

These are used to generate the balance sheet, which conveys the business’s financial health at that point in time and whether or not it owes money. Revenue and expense accounts are listed next and make up the income statement, which provides insight into a business’s profitability over time. There are five main account type categories that all transactions can fall into on a standard COA. These are asset accounts, liability accounts, equity accounts, revenue accounts, and expense accounts.

Although most accounting software packages like Quickbooks come with a standard or default list of accounts, bookkeepers can set up and customize their account structure to fit their business and industry. It ensures accurate financial reporting and record-keeping, facilitating the calculation of taxable income and adherence to tax laws. For example, all asset accounts might start with a 1, liabilities with a 2, and so on, leaving room within each category for additional accounts. The business should decide what accounting reports it needs and then provide sufficient account codes to allow the report to be produced.