Chart of Accounts Detailed Guide

Income tends to be the category that business owners underutilise the most. Let’s say that in the middle of the year Doris realizes her orthodontics business is spending a lot more money on plaster, because her new hire keeps getting the water to powder ratio wrong when mixing it. Get free guides, articles, tools and calculators to help you navigate the financial side of your business with ease. We provide third-party links as a convenience and for informational purposes only.

How can a COA help drive my business decisions?

The Chart of Accounts (COA) is essentially a listing of all account titles that a business may use to record transactions in an organized way. In contrast, the general ledger is where all financial transactions of a company 4 factors influencing local government financial decisions are recorded and summarized using the accounts from the COA. Accurate data recording lies at the heart of preparing a COA, and Journal Entry Management simplifies the creation and management of journal entries.

- Our intuitive software automates the busywork with powerful tools and features designed to help you simplify your financial management and make informed business decisions.

- Intuit Inc. does not have any responsibility for updating or revising any information presented herein.

- By selecting the appropriate type of COA, businesses can achieve more accurate and efficient financial management.

- However, they also must respect the guidelines set out by the Financial Accounting Standards Board (FASB) and generally accepted accounting principles (GAAP).

- For example the inventory codes run from 400 to 499 so there is plenty of room to incorporate new categories of inventory if needed.

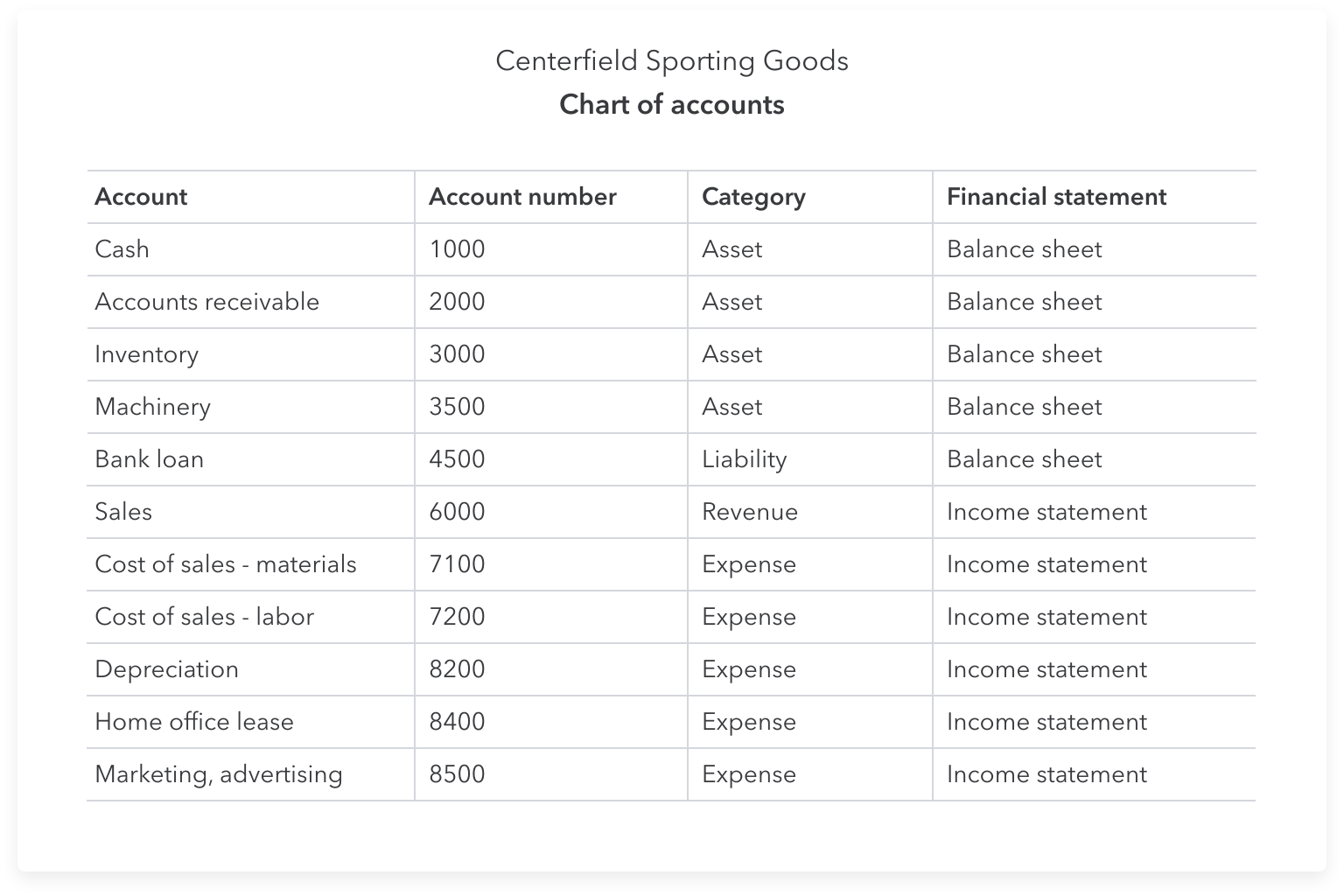

Assign account numbers to business accounts

The COA is the financial framework of any business, crucial for accurate financial documentation and analysis. Acting as the financial DNA of business accounting, it provides a detailed directory of various accounts essential for financial accounting practices. It encompasses all financial activities within an organization, with each account representing a distinct category – such as revenue, expense, or asset. Although the structure of a COA may vary to accommodate a business’s size, industry, and specific needs, its primary goal is to offer a clear and comprehensive view of the organization’s financial health. The exact layout of the accounting chart of accounts is a matter of choice depending on the exact reporting requirements of the business.

Which of these is most important for your financial advisor to have?

It also lays the foundation for all your business’s important financial reports. Charts of accounts are an index, or list, of the various financial accounts that can be found in your company’s general ledger. These accounts are separated into different categories, including revenue, liabilities, assets, and expenditures. Say you have a checking account, a savings account, and a certificate of deposit (CD) at the same bank. When you log in to your account online, you’ll typically go to an overview page that shows the balance in each account.

Standard Chart of Accounts Adaptation

They represent what’s left of the business after you subtract all your company’s liabilities from its assets. They basically measure how valuable the company is to its owner or shareholders. An easy way to explain this is to translate it into personal finance terms. When you log into your bank, typically you’ll get a dashboard that lists the different accounts you have—checking, savings, a credit card—and the balances in each. Learn how to build, read, and use financial statements for your business so you can make more informed decisions.

From automating journal entry preparation to automated posting, it significantly reduces the potential for human error and ensures consistent, accurate record-keeping. This is particularly beneficial for managing a COA efficiently, as it allows for real-time updates and minimizes discrepancies in financial data. The structure of a COA not only facilitates accurate financial recording and reporting but also ensures that all financial transactions are accounted for systematically. This significantly aids organization in financial analysis, compliance, and decision-making. Understanding how a chart of accounts works is important for effective financial management and reporting. COA organizes financial data into a structured format that can be easily accessed, analyzed, and reported.

Before recording transactions into the journal, we should first know what accounts to use. These standards provide guidelines for financial reporting, including the structure of the COA. So, separating these additional accounts allows businesses to understand the specific drivers of their financial performance in more detail. Other Comprehensive Income includes gains and losses that have not yet been realized but are included in shareholders’ equity. Separating Other Comprehensive Income allows businesses to track changes in the value of certain assets or liabilities over time. The chart of accounts deals with the five main categories, or, if you will, account types.

It generally helps to keep the most used accounts towards the top of each group as this helps speed up locating the account and the posting of double entry transactions. A well-structured COA provides a comprehensive view of financial activities, enabling detailed analysis for informed decision-making. It aids in identifying spending trends, profitable areas, and potential savings that are crucial for strategic planning and budgeting. For instance, a manufacturing business might need detailed accounts for different types of raw materials. Under each main category, create subcategories to further detail the transactions. This helps in organizing the accounts systematically and simplifies the process of adding new accounts in the future.

Here’s a deeper look at the mechanics of a COA and how it supports everyday accounting practices. The Chart of Accounts is an indispensable tool in the realm of accounting, vital for accurate and efficient financial management. Understanding its structure, types, and best practices is key to maintaining an organized financial record-keeping system. Revenue appears at the top line of the income statement, showing the total amount of money earned from sales or other business activities.